In a moving world, TSG and its skilled technicians are enabling a more sustainable world.

For all customers

We support all types of companies, from gas station networks to fleets, with a one-stop shop of innovative energy and retail solutions, paving the way towards responsible energies and expanding consumer offerings.

With technical & energy solutions

We are pioneers in the transition towards biofuels; now, we are disrupting the sector with gas and electric charge, and prepared on the coming hydrogen revolution. As mobility enters a new, more responsible era, we are helping shift the role of the service station, with new retail experiences, adjacent services, and innovative digital services. In doing so, we are defining the service station of the future.

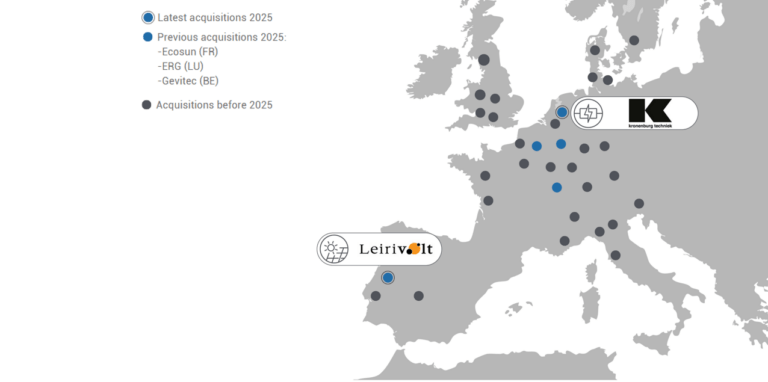

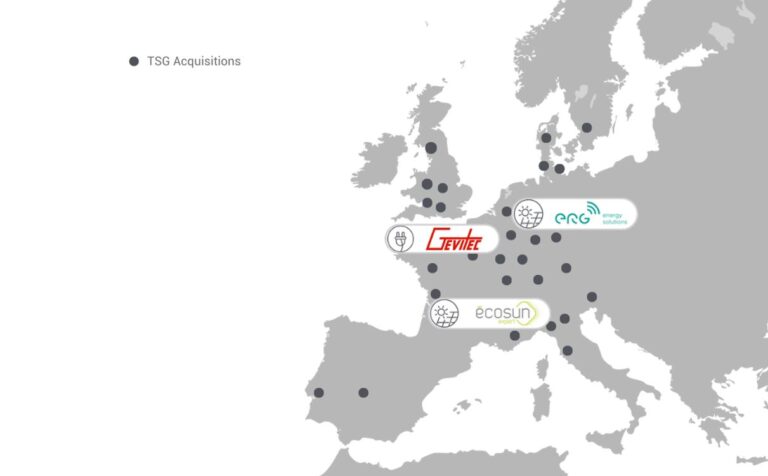

A unique growth story

We are growing fast, backed by an entrepreneurial culture and shareholder. Yet, all of this change is made possible by our people, 6.000 employees across 30 countries, and growing. They are our strongest asset, steering the energy transition on-the-ground and enabling a new era of responsible mobility solutions.

Moving to a sustainable world

By offering a one-stop-shop for innovative energy & retail solutions, we enable the transition to responsible mobility.

Business Segments

Traditional Energy

New Energy for Mobility

Systems & Payment