TSG and its skilled technicians are enabling a more sustainable world.

We support our professional customers in the energy transition; from service stations and mobility hub networks to fleet operators and beyond, by providing a one-stop shop of innovative energy and retail solutions – paving the way towards responsible energies and expanding consumer offerings beyond powering mobility.

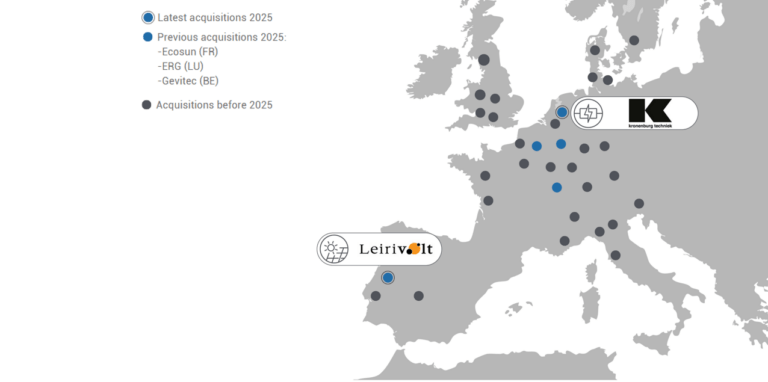

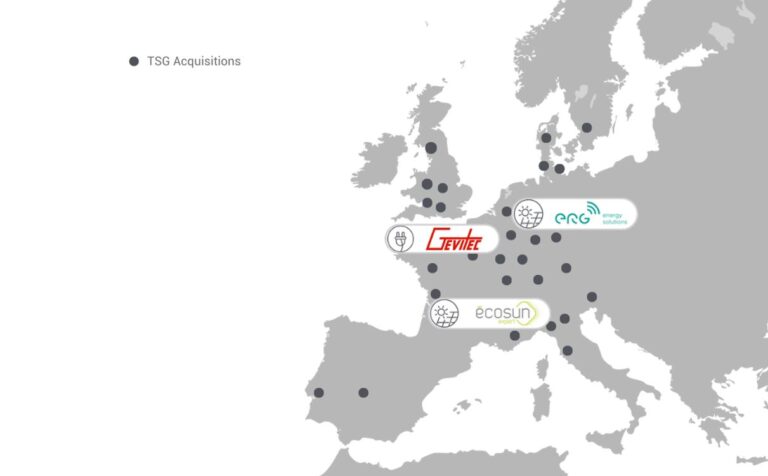

TSG operates the largest sales and service network in our industry across Europe and Africa in 30 countries, serving our customers promptly and efficiently. Wherever you are, we are just around the corner.